If you enjoy working with numbers and are interested in a career involving financial data and records, you might consider completing a bookkeeping certificate program.

Professionals with bookkeeper certification are equipped with the skills to track, organize, and manage financial data for their clients or organization.

Editorial Listing ShortCode:

If you are interested in accounting, earning your bookkeeper certificate could be a first step in building your skills in this field and entering the world of accounting at an entry-level position.

Online Bookkeeping Certificate Programs

Bookkeeping certificate programs can help prepare students for a career as a bookkeeper or related positions where these skills are needed.

Editorial Listing ShortCode:

Students who are successful in bookkeeper programs tend to like math and working with numbers. It’s helpful to be detail-oriented, organized, analytical, and comfortable with data entry.

Similar to an on-campus or online accounting certificate program, topics covered in bookkeeping certificate programs often include:

- Fundamental accounting procedures

- Spreadsheets and data entry

- Various types of bookkeeping software

- Financial reports

- Payroll processing

- Budgeting and expense reporting

- Computer applications for accounting

Some specific areas that may be covered in your program include financial accounting, Excel for bookkeeping, and managerial accounting.

Common positions related to bookkeeping include:

- Bookkeeper

- Financial clerk

- Payroll manager

- Accounts receivable clerk

Larger companies may have their own finance departments, and smaller companies may use the services of an independent bookkeeper.

Every industry has financial data that needs to be managed, including non-profit organizations, government agencies, and companies of every size. Many bookkeeping certificate programs can be completed in 1 year or less, making it an attractive option for those looking to use their skills quickly.

Earning your bookkeeping certificate can be a strategic way to enter into the field of accounting You can build a solid foundation of fundamental accounting skills. Some graduates may go on to pursue more advanced degrees in accounting in order to earn their CPA license or tax preparer certification.

Bookkeeping Careers and Salaries

Professionals with bookkeeping certification may find employment in various industries, including government agencies, non-profit organizations, and companies of all sizes.

Many graduates establish careers as bookkeepers either in a business or finance department or in private firms. Some graduates start their own bookkeeping practice and build their own base of clients.

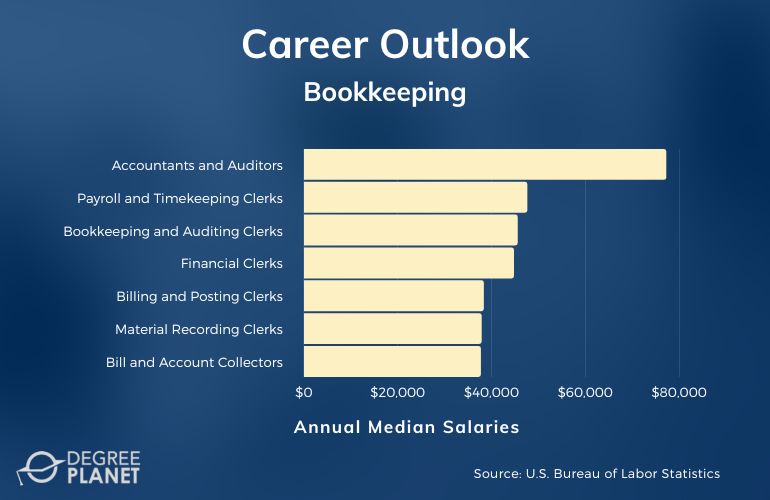

Based on data from the Bureau of Labor Statistics, below are some careers that can benefit from bookkeeping training.

| Careers | Annual Median Salaries |

| Accountants and Auditors | $77,250 |

| Payroll and Timekeeping Clerks | $47,610 |

| Bookkeeping, Accounting, and Auditing Clerks | $45,560 |

| Financial Clerks | $44,760 |

| Billing and Posting Clerks | $38,330 |

| Material Recording Clerks | $37,870 |

| Bill and Account Collectors | $37,700 |

| Information Clerks | $37,450 |

| General Office Clerks | $37,030 |

| Tellers | $36,310 |

Since every business has financial data that needs to be managed, bookkeepers may find employment in almost any industry.

Editorial Listing ShortCode:

Bookkeeping skills can also be applicable to entry-level accountant positions, accounts payable clerks accounts receivable clerks and financial clerks. Those who wish to build upon their bookkeeping training may go on to earn a degree in accounting. After completing an undergraduate degree, others may further pursue graduate programs like a masters in accounting online or on campus to qualify for managerial roles in the field.

Bookkeeping Online Certificate Curriculum & Courses

While courses vary between bookkeeping certificate programs, listed below are some common bookkeeping classes you may take:

- Basic Accounting Procedures: This course introduces bookkeeping procedures, including posting transactions, preparing financial statements, and using worksheets.

- Financial Accounting: Students in this course will learn to apply accounting principles to typical business transactions.

- Payroll and Wholesale Accounting: In this course, you’ll learn the fundamentals of accounting for payroll, accrual accounting, inventory, and wholesale accounting.

- End-of-Month Accounting: This course focuses on using computer programs to process end-of-month and end-of-year accounting processes.

- Computer Applications for Accounting: In this course, you’ll learn to use computerized accounting programs for various applications, including accounts receivable and payable.

- Revenue, Expenses, and Financial Reports: This course focuses on using standard bookkeeping forms and creating financial reports, including financial statements.

- Excel for Bookkeeping: You’ll learn to use Microsoft Excel to organize and track financial data using formulas and charts.

- Assets, Liabilities, and Owner’s Equity: This course focuses on tracking how individuals or businesses spend and earn money.

- Cost Accounting: This course introduces the fundamentals of cost accounting, including materials, overhead, and labor.

- Managerial Accounting: In this course, you’ll explore financial accounting data, cost allocations, budgets, and responsibility accounting, and cost-volume-profit analysis.

In addition to course requirements, some programs may have an end-of-program assessment required for program completion.

Admissions Requirements

While admissions requirements vary from program to program, below are some common ones for undergraduate certificate programs:

- Online application. Most programs require you to submit an online application before enrollment.

- Official transcripts. Undergraduate programs often require a copy of your official high school or college transcripts.

- SAT or ACT scores (if required). Some programs may require the submission of SAT or ACT scores, but a growing number of schools have eliminated this requirement.

In addition to the above criteria, some programs require you to pay a fee with the submission of your online application.

Bookkeeper Certificate Programs Accreditation

Accreditation is the process that ensures an educational institution meets a predetermined standard of quality. The most widely accepted type of accreditation is regional accreditation.

Accreditation can potentially affect everything from your additional education opportunities to your employment opportunities. Your certificate courses may only count toward related degree programs if your certificate is from a regionally accredited institution. In addition, some employers prefer applicants with educational training from regionally accredited schools.

Editorial Listing ShortCode:

You can visit the US Department of Education’s website for additional school accreditation information.

Bookkeeper Licensure and Certification

While you may find various bookkeeping certification offerings, here are two bookkeeping certifications that are nationally recognized.

- National Association of Certified Public Bookkeepers (NACPB): This option is designed for professionals who have a degree in accounting or have completed NACPB courses.

- American Institute of Professional Bookkeepers (AIPB): This option is for professionals who have no formal education but who have at least 2 years of experience in the field.

While there are some key distinctions between the two certifications, both require completing an exam and meeting continuing education requirements every year or a couple of years.

Financial Aid and Scholarships

As you look into bookkeeper programs, you might also consider the various resources that may help you financially. If you’re currently employed in a related field, or if your job requires bookkeeping skills, your employer might offer financial assistance, reimbursement, or reduced tuition opportunities.

Some bookkeeper certificate programs also offer assistance to active military or veterans. You can also explore funding available through state and federal loans, grants, or work-study programs. You can fill out the Free Application for Federal Student Aid (FAFSA) to apply for need-based aid.

You can also visit the Federal Student Aid website to learn more about the financial opportunities that are available to qualifying students.

What Can You Do with a Bookkeeping Certificate?

Graduates who have earned their bookkeeper certificate can use their skills in a range of positions. You may find employment opportunities in the financial department of larger companies managing payroll, accounts receivable, accounts payable, budgets, and inventory.

Alternatively, many graduates find work as bookkeepers for smaller businesses, either as part of an organization or working for themselves with their own clients. Some graduates find opportunities as entry-level accountants, financial clerks, payroll managers, and accounts receivable clerks.

How Long Does It Take to Get an Online Bookkeeping Certificate?

The time needed to complete your bookkeeping certificate program will vary based on a few factors, including the program you choose, the number of credits required, and your schedule.

Many programs can be completed in 1 year or less. Programs may offer a fast-track program that allows for accelerated study and completion in 6 months or less. Some programs are self-paced and offer more time for completion if needed with your schedule.

What’s the Difference Between a Certificate in Bookkeeping vs. Accounting Associates Degree?

Here are some of the differences between a certificate in bookkeeping and an associates degree in accounting.

| Certificate in Bookkeeping | Associates in Accounting |

|

|

While both programs require math skills, bookkeeping focuses more on financial transactions and organizing data, whereas accounting uses that data to draw broad conclusions.

Is a Bookkeeping Certificate Worth It?

Yes, a bookkeeping certificate is worth it for many professionals. Every industry needs professionals with the skills you can develop in a bookkeeping certificate program.

Opportunities for employment may be found in non-profit organizations, companies of all sizes, and government organizations at every level. Taking the time to earn an undergraduate certificate in bookkeeping could expand both your career opportunities and your earning potential.

Editorial Listing ShortCode:

If you are interested in a possible career in accounting, earning a bookkeeping certificate is a strategic way to gain entry into the field and see if it’s a good fit for you.

Universities Offering Online Bookkeeping Certificate Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Borough of Manhattan Community College offers a Bookkeeper Training Certificate. This program is designed to teach practical skills that may be applied in a wide range of industries. The curriculum covers topics like payroll, inventory, fraud depreciation, bank reconciliation, and adjusted trial balance. Coursework may be completed fully online.

BMCC is accredited by the Middle States Commission on Higher Education.

Columbus State Community College offers a Business Office Administration Bookkeeping Certificate. This program may be an excellent fit for those interested in pursuing work as a bookkeeper or accounting clerk. The curriculum is delivered in an online learning format. The 5 required courses can usually be completed in 2 semesters.

Columbus State Community College is accredited by the Higher Learning Commission.

Franklin University offers an Intuit Bookkeeping Certificate. The curriculum covers essential bookkeeping skills, such as the accounting cycle and how to analyze financial statements and evaluate assets, liabilities, and equity accounts. Classes may be taken entirely online and requirements can potentially be completed in just 3 to 4 months of full-time attendance.

Franklin University is accredited by the Higher Learning Commission.

Kennesaw State University offers a Certified Bookkeeper Certificate. Classes cover topics like correction of accounting errors, payroll, depreciation, inventory, fraud prevention, and internal controls. The completion of a minimum of 140 course hours is required to obtain the certificate. It is a self-paced program that can potentially be completed in just 6 months. The program enrolls new students year-round.

Kennesaw State University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Minnesota State College Southeast offers a Bookkeeper Certificate program that utilizes a combination of on-campus and online class delivery.

Typical course topics include payroll accounting, spreadsheet concepts and applications, word processing, and computerized account applications. Potential careers that can be pursued with this certificate include banking, budget analysis, auditing, financial services, and managerial, payroll, or financial accounting.

Minnesota State College Southeast is accredited by the Higher Learning Commission.

Santa Rosa Junior College offers a Bookkeeping Certificate that can be earned through a blend of online and in-person class meetings. The curriculum consists of 25 units and can usually be completed in 3 to 4 semesters. The program also includes an internship in a real-life office environment.

Santa Rosa Junior College is accredited by the Accrediting Commission for Community and Junior Colleges, Western Association of Schools and Colleges.

The State University of New York—Ulster offers an undergraduate Certificate in Bookkeeping that can be earned online. A minimum of 25 credit hours is required to earn the certificate. The curriculum emphasizes skills that are necessary for bookkeeping in government agencies and non-profit organizations, including accounting software, spreadsheets, and payroll taxes.

SUNY – Ulster is accredited by the Commission on Higher Education of the Middle States Association of Colleges and Schools.

Temple University offers a fully online program for a Certificate in Bookkeeping. The curriculum is designed to teach the skills used in the management of financial needs in a variety of businesses. Potential courses include Understanding Debits and Credits, General Ledger and Month-End Procedures, and Closing Procedures and Financial Statements. This program can potentially be completed in just 1 semester.

Temple University is accredited by the Middle States Commission on Higher Education.

The University of Georgia offers an online program for a Bookkeeping Certificate. The curriculum covers essential bookkeeping topics, like error correction, accruals and deferrals, payroll laws, security, internal audits, and accounting best practices. This program consists of 14 credits for a total of 140 course hours. It accepts new students year-round.

The University of Georgia is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Wake Technical Community College offers a Bookkeeping Certificate program that may be completed online, on-campus, or through a hybrid learning model. Potential courses in this 18 credit program include Business Math, Practices in Bookkeeping, and Accounting Software Applications. Coursework completed in the certificate program may be applicable toward a future associate degree in accounting.

Wake Technical Community College is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Earning Your Bookkeeping Certificate Online

Completing a bookkeeper certificate program online could help you expand your career opportunities and build your portfolio of professional skills.

You may find employment opportunities in almost every industry, with various ways to apply the skills learned in your bookkeeper program. You may also find opportunities to work for yourself with your own bookkeeping clients. If you decide to go on to pursue a degree in accounting, having your bookkeeper certification could provide you with a solid base of existing skills and knowledge.

If you wish to develop professional bookkeeping skills, you can look into bookkeeping certificate programs from accredited colleges and universities to find the one that’s right for you.