When you’re ready to take the next step in your accounting career, you might consider pursuing a masters in accounting.

Studying online is a convenient option for earning this advanced degree and getting the education you’ll need for furthering your career. Graduate accounting students learn how to take their reporting, auditing, and analysis skills to the next level.

Editorial Listing ShortCode:

If you’re ready to acquire the in-depth knowledge that a master’s program can provide, you might check out the flexibility of master in accounting online degrees.

Online Masters in Accounting Programs

You may have learned a lot about accounting during your undergraduate years, but this is a complicated field. There are still many more things you can learn about tax regulations, auditing processes, and financial records. A graduate program in accounting can help equip you with advanced skills so that you can take your career further.

You might study:

- Accounting and business ethics

- Auditing practices

- Budgets and cost accounting

- Data analytics

- Federal taxation

- Financial accounting and analysis

- Management

- Reporting methods

Some accounting graduate programs focus solely on accounting. Examples include the Master of Science (MS) in Accounting and the Master of Accountancy (MAcc). Other programs feature accounting as a concentration option within a Master of Business Administration (MBA).

Editorial Listing ShortCode:

Many colleges encourage students to engage in learning experiences in addition to their classroom studies. Some schools have students complete thesis papers or capstone accounting projects. Others may help their students find relevant internships through which they can gain relevant job experience.

Once you complete an accounting master’s degree, you may have enough college credits to qualify for the Certified Public Accountant (CPA) test. There are some accounting positions that require you to be a CPA, so this certification can be a valuable addition to your resume.

After graduation, you may find an accounting job with an accounting firm, a financial institution, a large company, or a government agency. Some accountants are self-employed.

Common Online Master of Accounting Concentrations

Accountants do many different jobs, so there are a wide variety of topics you can study within the accounting field. You can learn about one specific area within accounting when you select a concentration for your online master’s in accounting. Here are some common concentrations:

- Analytics for Accounting. You’ll explore technology and learn to evaluate data, maintain cybersecurity, and produce visual reports in this concentration.

- Corporate Accounting. Through classes in controlling and business planning, you can study to become a Certified Management Accountant (CMA).

- Internal and External Auditing. If you want to work as an auditor, then you could benefit from a concentration track with class topics such as financial fraud and forensic accounting.

- Public Accounting. If you know that you want to become a Certified Public Accountant (CPA), then you might appreciate a concentration that includes courses in financial reports, data analytics, accounting technology, and financial analysis.

- Taxes. You’ll take classes on tax research, estate taxes, and similar topics as you study to become a taxation expert.

Your school can provide information about whether a certain concentration will lead to any specific certification opportunities.

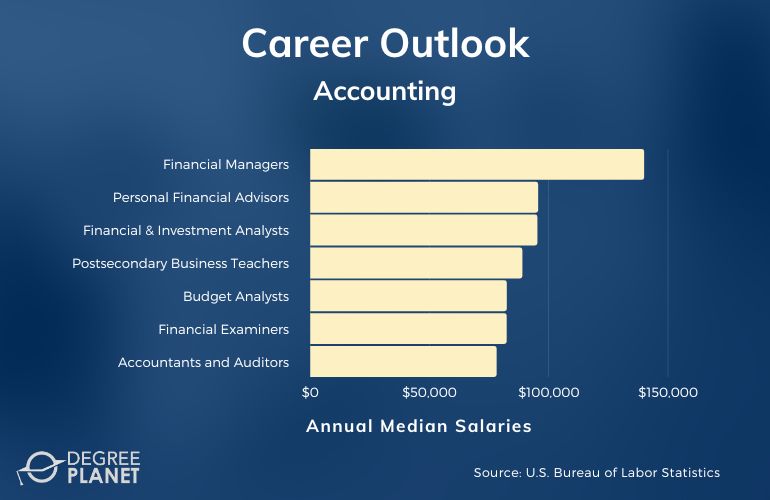

Accounting Careers & Salaries

A popular job for someone with a master’s degree in accounting is to work as an accountant. Professional accountants sometimes work for tax or accounting services to provide support to a number of clients. Other times, they work for businesses or other organizations to provide in-house accounting services.

Auditing is another job to consider with this degree. Auditors evaluate whether funds are being properly used and records are being accurately maintained. There are other financial jobs that could be suitable for someone with accounting training as well. For example, it might be possible to work as a budget analyst, a financial examiner, or a financial analyst.

Another idea is to work with clients as a personal financial advisor who helps people make savings and investment decisions. Some graduates work for banks. For instance, they might become loan officers who make decisions about lending money. Others may get jobs in the underwriting departments of insurance companies.

According to the Bureau of Labor Statistics, business, and financial jobs have a median annual salary of $76,850.

| Careers | Annual Median Salaries |

| Financial Managers | $139,790 |

| Personal Financial Advisors | $95,390 |

| Financial and Investment Analysts | $95,080 |

| Postsecondary Business Teachers | $88,790 |

| Budget Analysts | $82,260 |

| Financial Examiners | $82,210 |

| Accountants and Auditors | $78,000 |

| Insurance Underwriters | $76,230 |

| Loan Officers | $65,740 |

| Tax Examiners and Collectors, and Revenue Agents | $57,950 |

In some companies, getting hired as an accountant or a related professional might require CPA status or another certification.

Finance professionals who have experience might qualify for management positions. Working as a financial manager could involve compiling reports, making decisions, and supervising a team of finance staff. Insurance companies, corporations, and government agencies are some of the employers that hire financial managers. Another job idea might be to teach accounting at the college level.

Editorial Listing ShortCode:

A master’s degree probably isn’t enough for getting a tenured teaching job at a major university, but it could allow you to teach community college classes. That’s even something that you might be able to do on the side along with a full-time accounting job.

Master of Science in Accounting Curriculum & Courses

To earn your MS in Accounting online, it’s necessary to complete more than 30 credit hours. You’ll explore a variety of in-depth accounting topics and business leadership principles. Here are some course examples:

- Accounting Ethics: You’ll talk about what it means to be an ethical business leader who handles money responsibly and makes well-founded choices.

- Accounting Law: It is important for you to learn about the laws and regulations that govern financial practices and accounting reports.

- Advanced Cost Accounting: When you take a class in cost accounting, you might talk about pricing decisions, project budgets, and inventory tracking.

- Advanced Financial Accounting: You’ll go beyond the lessons on profit and loss that you learned at the undergraduate level as you learn to engage in accounting practices that can inform business decisions.

- Business Taxes: Taking this course can help you become an expert in handling companies’ federal tax responsibilities.

- Communication for Business Settings: This class will help you hone your skills for writing emails, delivering presentations, and persuading audiences.

- International Accounting: You can learn how to engage in accounting for businesses that have a global presence.

- Nonprofit Accounting Work: Because nonprofit organizations and government agencies have special taxation and reporting requirements, you might have a class that’s dedicated to working in such environments.

- Tax Research: You’ll get to know the federal tax code, practice finding relevant taxation information, and learn to work with the IRS on behalf of your clients.

- Technology for Auditing: As you learn how to use auditing software, you will also learn about legal regulations that govern their use.

If you select a particular concentration for your degree, you will have some classes that are specific to that subfield.

Online Master of Accountancy Admissions Requirements

Accounting master’s degree programs often set strict admissions standards to ensure that the students in their programs are ready for in-depth accounting studies. Common criteria include:

- Application form

- Cover letter or personal statement about your interest in the program

- Reference letters

- Resume or curriculum vitae

- Bachelor’s degree in accounting or a related field from an accredited university

Some graduate programs admit students who don’t have an undergraduate background in accounting or business, but those students must first take some foundational courses.

Online Accounting Masters Programs Accreditation

Regional accreditation is a sign that a college offers quality educational programs that prepare students for success in the workforce. Schools earn this distinction by undergoing a careful evaluation process by a regional accrediting organization.

Editorial Listing ShortCode:

For your online master degree in accounting, it’s strategic to choose a school with regional accreditation so that you’ll earn a respected degree. Accreditation may qualify you to take a certification exam or pursue a promising job. You may be in a good position for admission to certificate or doctoral programs as well. Plus, accredited courses often transfer between schools.

Accounting Licensure and Certifications

There are several important certification programs in the world of accounting. Pursuing one or more could help open up new job opportunities for you.

- Certified Internal Auditor (CIA): This certification demonstrates that you are qualified to audit large companies.

- Certified Management Accountant (CMA): A CMA understands how accounting and business work together in areas like budgeting, financial reporting, and decision-making.

- Certified Public Accountant (CPA): It’s necessary to complete at least 150 college hours in accounting programs to take the exam for becoming a CPA.

If you hold CPA status, you may qualify to become licensed as a public accountant in your state.

Financial Aid and Scholarships

If you want a hand with paying for your online accounting master degree tuition, there are a variety of programs that could help.

Government student aid is a major source of tuition help for many students. Typically, graduate students are more likely to get loans than grants from the federal government. State-level programs can vary from place to place. To learn about your eligibility for government aid, you can complete the Free Application for Federal Student Aid (FAFSA).

You might benefit from scholarship or fellowship programs as well. Your school may award these opportunities directly. You could also apply to programs administered by industry associations, community groups, or other organizations.

You can also check with your employer about any potential funding help. Some workplaces run tuition reimbursement programs as an employee benefit, especially for studies that are directly relevant to your role in the company.

What Is a Masters in Accounting Degree?

A masters degree in accounting is an advanced college program for people who want to build upon their undergraduate accounting education.

At the master’s degree level, you’ll go into greater depth on topics related to taxation, cost accounting, auditing, and financial accounting. This degree program can help you gain the required credit hours for taking the CPA exam. It might also prepare you to become credentialed with other industry certifications.

Accounting master’s degree programs often allow for specialization in a certain area. Possible specialties include public accounting, data analytics, and managerial accounting.

What Can I Do with a Masters in Accounting Online Degree?

If you get a master’s in accounting, there’s a good chance that you’ll decide to work as an accountant. You might want to perform in-house accounting for a big company, work as a self-employed tax preparer, or get hired by an accounting firm that services multiple clients.

Another job idea is to work as an internal or external auditor. After gaining experience as an auditor or an accountant, you might be qualified to work as a financial manager.

How Long Does It Take to Get a Master’s Degree in Accounting Online?

If you’re a full-time student, you can probably earn your accounting master’s degree online in about 1 to 2 years. The exact length of time it takes will depend on your availability, the number of credits required, and the structure of your school.

Editorial Listing ShortCode:

Many online colleges prioritize quick degree completion because they know that working professionals are busy people. To help students reach graduation quickly, they offer year-round studies and courses that are arranged in 8 week terms. Attending school part-time or choosing a program with a thesis requirement can increase the length of time you’re in school.

What’s the Difference Between an MBA vs. Masters Programs in Accounting?

You might consider how you’d like to study accounting. You could do a standalone program or include accounting studies within a Master of Business Administration (MBA) program.

| MBA in Accounting | Masters in Accounting |

|

|

You can always consult an admissions counselor if you need help deciding which is right for you, a masters in accounting or MBA in Accounting online or on campus.

What’s the Difference Between Finance vs. Accounting Master Programs?

If you’re interested in a graduate program that deals with money and business, then you could consider a finance degree or an accounting degree.

| Masters in Finance | Masters in Accounting |

|

|

For either program, it’s helpful to have strong math skills.

Is an Online Master in Accounting Degree Worth It?

Yes, an online master in accounting degree is worth it for many students. Getting a masters in accounting degree online can provide the educational background that’s needed for earning your CPA credentials. Having that certification could help you qualify for raises, promotions, or leadership opportunities.

Editorial Listing ShortCode:

An online accounting master’s degree could get you ready for other certifications as well. Certified Management Accountant (CMA) is a popular example. According to the Bureau of Labor Statistics, jobs in accounting and auditing are growing at a 6% rate over the next ten years. Accountants who have advanced skills in technology and data analytics may be particularly in demand.

Universities Offering Online Masters in Accounting Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Boise State University offers a Master of Science in Accountancy. This program is designed to equip graduates to sit for their Certified Public Accountancy exam. The program is housed entirely online. With part-time study, it is possible to finish in as few as 22 months, while those who attend classes full-time may be able to complete the course requirements in as little as 12 months.

Boise State University is accredited by the Northwest Commission on Colleges and Universities.

California State University—San Bernardino offers a Master of Science in Accountancy. The program boasts a convenient online learning model, Certified Public Accountancy exam preparation, and expert faculty. Degree requirements may be completed in as little as 16 months. Many graduates often pursue careers in settings like government offices, financial firms, non-profit organizations, and corporate accounting departments.

California State University – San Bernardino is accredited by the Western Association of Schools and Colleges.

Emporia State University offers a Master of Accountancy. Potential courses include Advanced Management Accounting, Advanced Auditing, Accounting Theory, and Federal Income Tax. This program utilizes a fully online learning format. On average, those who attend classes full-time complete their 30 required credits in as few as 12 months.

Emporia State University is accredited by the Higher Learning Commission.

Florida Atlantic University offers a Master of Arts in Accountancy. Courses typically cover key topics in the field, like business communications, accounting information technology, financial reporting, accounting theory, income tax, and auditing. The curriculum consists of 10 courses for a total of 30 credits. All classes can be attended entirely online.

FAU is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Florida International University offers a Master of Accounting. The program offers the ability to tailor studies to specific professional goals by selecting a specialization in either taxation or assurance. This program meets 100% online and usually spans 10 months of full-time attendance. Incoming student applications are considered twice each year in summer and fall terms.

Florida International University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Maryville University offers a Master of Science in Accounting. Concentrations are available in subjects like Business Analysis and Reporting or Information Systems and Controls. All coursework can be completed conveniently online. Common careers for graduates include actuary, auditor, budget analyst, certified public accountant, chief financial officer, financial advisor, forensic accountant, or financial planner.

Maryville University is accredited by the Higher Learning Commission.

Pace University offers a Master of Science in Accounting. This program may be an ideal fit for current or aspiring accountants seeking professional exam preparation and career advancement. Courses typically cover concepts like financial reporting, auditing, contemporary accounting issues, information systems, and income tax. The program utilizes a convenient online learning format and typically spans 1.5 years.

Pace University is accredited by the Middle States Commission on Higher Education.

Purdue University offers a Master of Science in Accounting. Available concentrations include Tax, Public Accounting and CPA, or Private and Corporate CMA Accounting. Classes meet online and are usually 6 weeks long. The 52 required credits can typically be completed in as little as 1.5 years when devoting at least 20 hours a week to coursework.

Purdue University is accredited by the Higher Learning Commission.

Rutgers University offers a Master of Accountancy. The program offers a wide range of elective coursework in topics like auditing, forensic accounting, analytics, and information systems to accommodate long-term goals. The curriculum consists of 30 total credits. All classes can be completed 100% online with full-time and part-time attendance tracks.

Rutgers is accredited by the Middle States Commission on Higher Education.

Southern New Hampshire University offers a Master of Science in Accounting. Graduates often pursue careers in banking, taxation, insurance, or financial departments in numerous industries. The curriculum is housed entirely online. The program offers opportunities to work toward additional CPA certificates in Business Analysis and Reporting, Information Systems and Controls, or Tax Compliance and Planning.

SNHU is accredited by the New England Commission of Higher Education Inc.

SUNY Polytechnic Institute offers a Master of Science in Accounting. This program may be an excellent next step for those interested in preparing for a Certified Public Accountant licensure. At least 33 credits must be completed to graduate. All classes meet online and can be attended using a part-time or full-time schedule.

SUNY Poly is accredited by the Middle States Commission on Higher Education.

Texas A&M University offers a Master of Science in Accounting. The program may be customized to meet specific professional interests by selecting specializations in audit or tax accounting. Potential courses include Data Analytics, Critical Accounting Communication, Financial Reporting, and Business Application Modeling. The degree requirements can be completed entirely online.

Texas A&M University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Alabama—Birmingham offers a 100% online Master of Accounting. This program boasts a generous transfer credit policy, scholarship opportunities, and around-the-clock technical support. The 30 required credits can typically be completed in 5 semesters. Graduates often pursue careers in settings like private companies, banks, non-profit organizations, government agencies, and accounting firms.

The University of Alabama – Birmingham is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Arizona offers a Master of Science in Accounting. The curriculum consists of 30 credits total of accounting and business coursework. The program reviews incoming student applications 6 times each year. This fully online program can typically be completed in 12 months of full-time attendance.

The University of Arizona is accredited by the Higher Learning Commission.

The University of Colorado—Denver offers a Master of Science in Accounting. Experienced and aspiring accountants who are interested in obtaining innovative leadership roles in their field may find an excellent fit in this program. The program’s convenient online learning model is designed with busy working professionals in mind. The curriculum consists of 30 total credits.

The University of Colorado – Denver is accredited by the Higher Learning Commission of the North Central Association of Colleges and Schools.

The University of Connecticut offers a Master of Science in Accounting. The program boasts an online learning model, expert faculty members, and a GMAT exam waiver. A total of 30 credits are required to graduate. There are 3 start dates each year in fall, spring, and summer terms.

The University of Connecticut is accredited by the New England Commission of Higher Education.

The University of Houston offers a Master of Science in Accountancy. Available concentrations include Assurance and Financial Reporting, Tax Compliance and Consulting, and Business Advisory and Internal Audit. The program has 3 start times each year in fall, spring, and summer terms. All classes meet fully online.

The University of Houston is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Illinois—Urbana Champaign offers an online Master of Science in Accounting. This program aims to teach the skills required for a wide array of roles within the accounting field as well as Certified Public Accountancy exams. The coursework typically requires about 10 to 15 hours of study per week. The program requires at least 32 completed credits to graduate.

The University of Illinois Urbana – Champaign is accredited by the Higher Learning Commission.

The University of Louisiana—Lafayette offers a Master of Science in Accounting. Common careers for graduates include roles in public accounting, diverse industries, government agencies, consulting, and research. This program is housed entirely online. The required 30 credits can potentially be completed in 1 year when attending classes full-time.

The University of Louisiana – Lafayette is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Michigan—Flint offers a Master of Science in Accounting. This program is designed to teach the skills required for the next step in accounting regardless of past professional and educational experiences. The required coursework can be completed conveniently online. On average, the degree program can be finished in 10 months of full-time study.

The University of Michigan – Flint is accredited by the Higher Learning Commission.

The University of Nevada—Reno offers a Master of Accountancy. The curriculum focuses on essential elements in the accounting field, such as advanced practice, tax law, financial analysis, and reporting. Tracks are available for those new to accountancy and those with former accounting experience. All classes meet asynchronously online.

The University of Nevada – Reno is accredited by the Northwest Commission on Colleges and Universities.

The University of North Carolina—Chapel Hill offers a Master of Accounting. The program’s convenient online learning format is designed to accommodate even the busiest schedules. Depending on previous educational experience, 36 to 48 credits must be completed. There are 4 start dates available each year, in spring, summer, and fall terms.

The University of North Carolina – Chapel Hill is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Oklahoma offers a Master of Accountancy. The program boasts an online learning format, expert faculty, and plentiful networking opportunities. Degree requirements can typically be completed in less than 2 years with full-time study. There are 3 start dates each year.

The University of Oklahoma is accredited by the Higher Learning Commission.

The University of West Florida offers a Master of Accountancy online. Available specializations include Analytics, Business Analysis and Reporting, Information Systems and Controls, and Taxation. The program consists of 30 total credits. Potential courses include Corporate Income Tax, CPA Examination Review, Big Data Mining, and Tax Research and Procedure.

The University of West Florida is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Western Governors University offers a Master of Accounting. The curriculum covers topics like forensic accounting, strategic management, auditing, financial accounting, management communication, and nonprofit accounting. This program utilizes a fully online learning model. On average, the required coursework can be completed in 24 months of full-time study.

Western Governors University is accredited by the Northwest Commission on Colleges and Universities.

Getting Your Master’s in Accounting Online

A master’s in accounting degree can be a strategic way to develop your skills and prove your capability in this field. The education you earn may lead to increased job opportunities, higher earning potential, and new certifications.

You may become a valued accounting professional who contributes to the financial success of individuals or organizations. Accredited schools provide a thorough, effective education that’s able to get you workforce ready, and online graduate classes offer the opportunity to earn this degree in a way that works for you.

You could take the next step in your educational journey by exploring online accounting schools for your graduate studies.