Those who have an undergraduate degree in business, finances, economics, and accounting may wish to further their studies with a masters in finance.

In fact, many students and professionals who are interested in advancing a career in these fields pursue this opportunity. Though a background in finance isn’t always necessary for these programs, a professional passion in finance could help you advance your education and career.

Editorial Listing ShortCode:

Read on to learn how earning a master’s in finance can help you grow your professional qualifications as well as your career opportunities.

Online Masters in Finance Programs

You might be considering pursuing a master degree in finance based on your undergraduate degree, job experience, or long-term professional goals.

Editorial Listing ShortCode:

A graduate-level finance degree typically covers a variety of skills. The courses you take are often determined by the concentration you choose and what you hope to do with your degree after graduation.

Overall, you’ll immerse yourself in learning how to:

- Analyze a financial situation, including risks, gains, and potential

- Plan a financial future, including long- and short-term earning strategies

- Interpret and interact with the global market

- Mitigate financial risk and reduce exposure

- Work within a legal and ethical framework

You will likely take courses that focus not only on the topics of financial analytics, economics, law, and financial management but also on the various theories and procedures involved with each. You’ll be encouraged to analyze, forecast, and evaluate different financial situations. Depending on the courses you select, you may dig deeper into financial problems and solutions for corporate settings, government entities, business owners, and private clients.

When earning your masters degree in finance, it could be beneficial to first consider what you hope to accomplish with your degree. That way, you can select the courses and concentration that best align with your overall professional and educational goals.

Common Online Master in Finance Concentrations

Within the context of a masters degree in finance, many schools allow students to choose a concentration that focuses on a particular area within finance.

Each school will offer its own unique concentrations, but a few popular options include:

- Corporate Finance. This concentration focuses on the financial considerations of corporations, including profitability, cost analysis, and risk management.

- Investments and Securities. Students will center their studies on types of domestic and international investments and securities, including applications, risks, and benefits.

- Financial Analysis. In this concentration, students will learn how to apply knowledge of loss, gains, and risk to portfolio management or profitability.

- Financial Planning. This concentration helps students learn how to guide individuals who are working to meet specific financial goals.

- Treasury Management. Students will learn how to achieve financial stability within a corporate setting, including holdings and profitability.

Though you will likely be asked to complete certain core classes, choosing a concentration allows you to take courses that will provide you with specialized knowledge about a specific area of interest.

Finance Careers & Salaries

Generally speaking, those who earn their MFin degree continue into financial, banking, or business fields.

These roles are important in every industry, from helping individuals with their finances to guiding large corporations or government entities. As a result, there are many types of careers that can benefit from receiving a Master of Science in Finance.

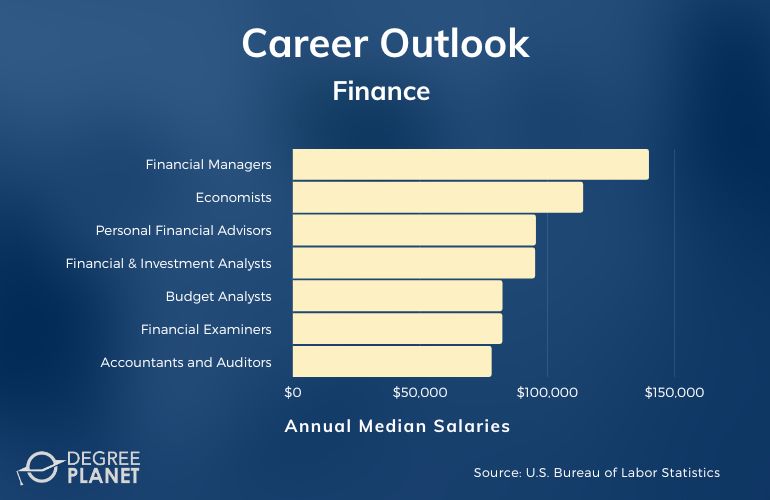

According to the Bureau of Labor Statistics, here are the median annual salaries of careers related to finance.

| Careers | Annual Median Salaries |

| Financial Managers | $139,790 |

| Economists | $113,940 |

| Personal Financial Advisors | $95,390 |

| Financial and Investment Analysts | $95,080 |

| Budget Analysts | $82,260 |

| Financial Examiners | $82,210 |

| Accountants and Auditors | $78,000 |

| Cost Estimators | $71,200 |

| Securities, Commodities, and Financial Services Sales Agents | $67,480 |

| Loan Officers | $65,740 |

Individuals in these positions may work as employees of a business or government agency, as contractors, or as their own independent service.

Editorial Listing ShortCode:

Depending on your background and career goals, you may wish to focus your skills on areas such as personal financial and investment advice, economic research, or analyzing financial risk and opportunities.

MS in Finance Curriculum & Courses

Each school will provide its own unique curriculum. Additionally, each potential concentration will likely include highly specialized courses within a particular topic.

Some common core courses for Master of Science in Finance studies include:

- Economics for Managers: This course combines a study of economics and financial forecasting with the roles and responsibilities of a leader.

- Risk Management: In this course, you’ll examine how to predict, interpret, and mitigate risk in financial scenarios.

- Financial Considerations for Corporate Management: Students will understand how various levels of corporate management contribute to the bottom line, including budgeting and profit distribution.

- Capital Markets: This course provides students with an understanding of the process, experience, risks, and considerations of trading financial assets.

- Financial Modeling: You’ll learn how to discover and interpret trends within the financial world in order to forecast changes and potential impacts.

- Global Economics: This course provides insights into how the global economy can impact domestic and international financial transactions and opportunities.

- Overseas Investments: In this course, you’ll focus on how the international market works and what to consider when analyzing investment opportunities.

- Accounting: You’ll dive into balancing profits and losses as well as examining expenses and opportunities.

- International Finance: This course encourages you to examine international currency, business regulations, and exchange rates in order to analyze financial products and opportunities.

- Quantitative Financial Research: In this course, students consider the research process when examining financial accounts or situations, including how to collect and analyze evidence.

Depending on your concentration, you may also take courses that help you develop managerial, communication, and business skills as well.

MSF Degree Admissions Requirements

Before you start the application process, it’s beneficial to review each school’s admissions requirements.

While each school may have its own specific requirements, a few common criteria include:

- GRE or GMAT scores (only some schools require them)

- Transcripts of undergraduate education

- Letters of recommendation

- Personal statement

- Resume or CV

Many Master of Science in Finance programs ask students to explain their interest in the program either through a letter of intent or an interview with program staff. Schools may also request academic writing samples.

Online Finance Masters Programs Accreditation

Regional accreditation is a process through which schools are evaluated for academic excellence. For information on the process, you can take a look at the Council for Higher Education Accreditation (CHEA).

Editorial Listing ShortCode:

There are many potential benefits to earning your MFin degree through an accredited institution. Some employers and professional organizations require candidates and applicants to have earned their degrees through an accredited school. Some financial assistance opportunities are only offered to those attending accredited schools as well.

AACSB Accreditation

The Association to Advance Collegiate Schools of Business, known as AACSB International, is the preferred accrediting body for master’s in finance programs. Programmatic accreditation helps ensure that a finance program is up to industry standards.

Established in 1916, AACSB is involved in business education for 1,850 professional member organizations and nearly 1,000 business schools around the world, with an emphasis on diversity, inclusion, and a global mindset. The goal of the AACSB is to provide excellence in education and networking support for business students everywhere.

Financial Aid and Scholarships

For students who are interested in assistance paying for their master degree in finance, there are many options to consider.

Those who are considering needs-based assistance may wish to complete the FAFSA, or Free Application for Federal Student Aid. You may also wish to review any scholarships, grants, or payment programs offered through the school you choose. Scholarships and grants are also offered through professional organizations, individual donors, and community initiatives.

You may also wish to connect with your employer to determine what types of educational assistance or tuition reimbursement programs they may offer.

What Can You Do with a Masters in Finance?

A master’s in finance can be an advantageous degree for many professionals. Those who are interested in roles in corporate, business, government, and banking may benefit from an MFin degree. Individuals who wish to work as personal financial advisors or planners may also choose to pursue a masters in finance.

As noted by the Bureau of Labor Statistics, career opportunities in fields such as financial analysis or management and personal advising are expected to increase over the next ten years. Job growth in these areas could open more positions for consultants, analysts, managers, and self-employed professionals.

How Long Does It Take to Get a Masters in Finance Online?

The length of time it takes to earn your Master of Science in Finance online depends on the program structure and your enrollment status. Being a full-time student can help you complete the courses more quickly, while part-time enrollment can extend the process.

Most masters programs can be completed in 1 to 2 years with full-time study. If you select a 36 credit hour program with no thesis requirement, you may be able to earn your MFin degree in 1 year, provided you study year-round, including summer term. If a thesis is required, it may take additional time for you to complete your degree.

What Jobs Can You Get with a Masters in Finance?

Many professionals in the business and financial fields can benefit from earning a masters in finance degree online.

Some graduate students are interested in becoming personal financial advisors for families and individuals, while others want to work for large corporations in an accounting, budget, or analytic role. Those who earn their master’s in finance may choose to work in business, as an entrepreneur, within a government agency, or as a contractor or consultant.

Editorial Listing ShortCode:

Common job titles in this field include financial manager, financial analyst, budget analyst, and personal financial advisor.

What’s the Difference Between an MBA vs. Masters in Finance Degree?

An on campus or online MBA in Finance and a masters in finance sound similar, and they often cover the same topics, to a point. There are a few differences in the level of finance education, though.

| MBA in Finance | Masters in Finance |

|

|

A masters in finance degree allows students to drill down into various areas of focus. Meanwhile, a Master of Business Administration (MBA) in Finance will provide instruction for those looking to work in business and management roles.

Is a Masters in Finance Worth It?

Yes, a masters in finance is worth it for many students. If you wish to seek a career path in business, banking, personal finance, budget planning, or accounting, a masters degree in finance could be a strategic next step in your professional journey.

According to the Bureau of Labor Statistics, overall employment for business and finance occupations is expected to grow 7% over the next ten years. In particular, job growth for financial analyst and manager roles is anticipated to grow faster than average.

Editorial Listing ShortCode:

A masters in finance could help you grow your expertise, qualifications, earning potential, and marketability in this growing field.

Universities Offering Online Masters in Finance Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Auburn University offers a Master of Science in Finance. Potential courses include Costs Analysis and Systems, Applied Financial Management, Global Financial Markets, Real Estate Finance, and Advanced Investments. Up to 6 of the 30 required credits may be transferred into the program. All classes meet conveniently online.

Auburn University is accredited by the Southern Association of Colleges and Schools.

Harvard University offers a Master of Science in Finance. The degree can be customized with stackable certificates in fields like business economics, corporate finance, data analytics, principles of finance, real estate investment, and applied fintech and digital assets. Classes meet primarily online, though occasional weekend or summer visits to campus may be required.

Harvard University is accredited by the New England Commission of Higher Education.

Indiana University offers a Master of Science in Finance. Graduates commonly pursue careers such as financial analysts, insurance underwriters, auditors, budget analysts, commercial bankers, financial planners, portfolio managers, or stockbrokers. The curriculum consists of 30 credits. The degree can be customized with online courses and part-time or full-time attendance options.

Indiana University is accredited by the Higher Learning Commission.

Pennsylvania State University offers a Master of Finance. This program is designed to cover concepts like advanced financial and investment management. This program utilizes a fully online learning model and requires 33 credits in order to graduate.

Penn State is accredited by the Middle States Commission on Higher Education.

Southern New Hampshire University offers a Master of Science in Finance. Concentrations are available in Corporate Finance or Investments and Securities. Up to 12 of the 36 required credits may be transferred into the program. The program’s convenient online model provides around-the-clock access to coursework.

SNHU is accredited by the New England Commission of Higher Education, Inc.

The University of Arizona offers a Master of Science in Finance. Common courses include Strategic Cost Analysis, Financial Economics, Applied Portfolio Management, and Financial Analysis and Security Valuation. Classes meet online and are 6 weeks long. On average, the required coursework can be completed in 2 years when attending classes full-time.

The University of Arizona is accredited by the Higher Learning Commission.

The University of Miami offers a Master of Science in Finance. Many graduates pursue careers like financial analyst, chief financial officer, private wealth manager, financial planner, or budget manager. Classes are 7 weeks long and are housed online. On average, the 8 required courses may be completed in 16 months.

The University of Miami is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Oklahoma offers a Master of Science in Finance. The curriculum covers concepts like mergers and acquisitions, corporate finance, risk management, derivative securities and markets, and restructuring. With full-time attendance, the 32 required credits can be completed in 16 months. All classes meet online.

The University of Oklahoma is accredited by the Higher Learning Commission.

Webster University offers a Master’s in Finance. Depending on professional goals, the degree can be completed as a Master of Business Administration or Science. The curriculum consists of 36 credits. Potential courses include Financial Statement Analysis, Managerial Accounting for Decision Making, International Finance, and Capital Budgeting and Corporate Investments.

Webster University is accredited by the Higher Learning Commission.

William & Mary offers a Master of Science in Finance. Graduates may pursue careers as finance officers, forensic accountants, investment banking analysts, actuaries, corporate controllers, or portfolio managers. Classes meet fully online and are 7.5 weeks long. On average, the 32 required credits may be completed in 16 16 months.

William & Mary is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Getting Your Master of Finance Online

Earning a masters degree in finance can be a strategic opportunity for current and aspiring professionals in business and financial fields.

If you are interested in understanding financial needs and considerations and finding practical solutions to financial problems, a masters program in finance can help you grow your expertise. Whether you wish to work for a publicly held corporation or maintain a book of private clients, earning your masters in finance can be beneficial for a variety of potential professions.

You can take a look at the variety of online programs offered by accredited schools to help you decide on the MFin program that’s right for you!