What can you do with a finance degree? Finance is one of the most popular college majors, but many people underestimate the number of ways that they can apply this versatile degree in the real world.

A finance degree focuses on obtaining, managing, and increasing the value of assets and investments. Finance majors can pursue numerous career paths in business, education, healthcare, tech, and other industries.

Editorial Listing ShortCode:

Read on to discover whether a finance major is right for you.

What Can You Do with a Finance Degree?

All public and private organizations must acquire and manage income and other assets to keep operating and achieve growth. As a result, there are many careers for finance majors in virtually every industry.

Many graduates get jobs with banks, credit unions, pension funds, and other financial institutions. For example, some professionals help clients and corporations grow their assets by working as investment bankers and portfolio managers.

Other finance professionals work as credit analysts, equity research analysts, and risk analysts. These specialists collect, clean, and analyze various types of data. They use their findings to reduce risk and help clients or managers make strategic financial choices.

Editorial Listing ShortCode:

In addition, some people use their finance degrees to secure positions in the insurance industry as actuaries, financial analysts, and underwriters. These professionals use data analytics and other tools to assess and mitigate risk.

Graduates may also become personal financial advisors for individuals and families. They can work closely with clients to help them formulate and meet their financial goals. For example, they can assist clients with investment decisions and recommend retirement plans.

The Bureau of Labor Statistics anticipates that the number of jobs for business and financial professionals will grow by 7% over the next ten years.

5 Things You Can Do with a Finance Degree

Are you wondering what a finance degree can do for you? Here are five lucrative careers that finance majors may pursue for after graduation.

1. Actuary

An actuary uses financial models and statistics to analyze data and predict potential outcomes of business decisions. They use the insights they gain from this forecasting to help organizations develop strategies that mitigate risk.

Actuaries typically work for financial institutions and insurance companies. For example, an actuary who works in insurance could assess data about car accidents in a specific city and recommend that the company raise premiums there.

2. Loan Officer

A loan officer works directly with clients at a bank or credit union. They help individuals and organizations understand and navigate the application process for various loans, such as mortgages and business loans.

Additionally, a loan officer performs credit checks and approves or denies loans based on the applicant’s credit history. They also help approved clients fill out documentation and ensure that all loans comply with relevant laws and regulations.

3. Compensation and Benefits Manager

A compensation and benefits manager typically works in the human resources department of a business or nonprofit organization. They research market trends to ensure that their organization offers competitive employee benefits packages.

These professionals also administer insurance plans and other employee benefits. For example, they may help workers add new dependents to their health insurance and negotiate paid time off for new hires.

4. Management Analyst

A management analyst helps organizations boost productivity, streamline workflows, and solve challenges. Typically, they start this process by gathering and evaluating data related to their client’s business operations. This data can include employee surveys, income reports, inventory levels, and many other types of information.

Based on their findings, the management analyst identifies problems and recommends ways to improve performance. They can also help organizations implement changes.

5. Accountant

An accountant generates and manages financial documentation for individuals or businesses. They help their employers maintain accurate records of expenses, sales, employee payrolls, and other financial transactions.

Editorial Listing ShortCode:

In addition, accountants ensure that their clients or employers comply with financial regulations and make accurate tax payments. They may also offer advice about financial decisions, such as acquiring assets or selling stocks.

Finance Careers & Salaries

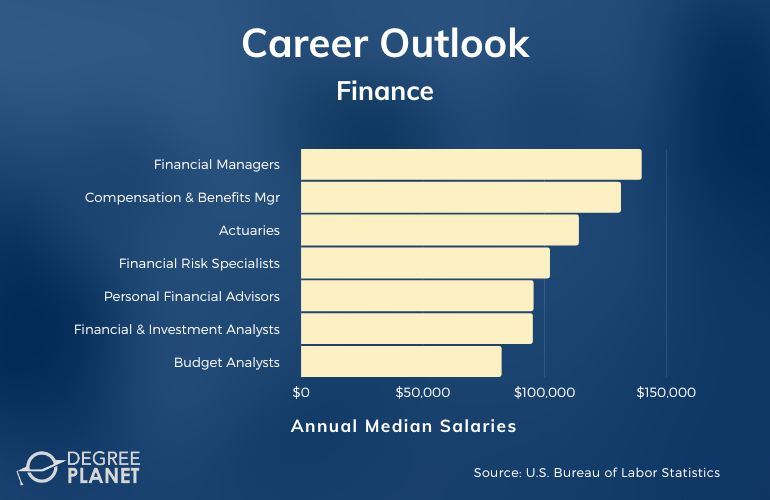

Many finance major jobs can offer lucrative salaries, but it’s beneficial to research the average wages for positions of interest before you choose a career path.

According to the Bureau of Labor Statistics, here are the median salaries for a few careers you may consider with a finance degree.

| Careers | Annual Median Salaries |

| Financial Managers | $139,790 |

| Compensation and Benefits Managers | $131,280 |

| Actuaries | $113,990 |

| Financial Risk Specialists | $102,120 |

| Personal Financial Advisors | $95,390 |

| Financial and Investment Analysts | $95,080 |

| Budget Analysts | $82,260 |

| Accountants and Auditors | $78,000 |

| Securities, Commodities, and Financial Services Sales Agents | $67,480 |

| Loan Officers | $65,740 |

Many factors can affect your starting salary, such as the company, geographic region, negotiation skills, the overall state of the economy, and your amount of experience.

Depending on the employer, you may need additional education or work experience to qualify for some of these jobs. Some companies may prefer you to pursue an MBA or DBA in Finance online or on campus to be considered for these careers. As you gain experience, you can also work your way toward management positions.

Pros and Cons of a Career in Finance

If you’re interested in a career in finance, there are many pros and cons to consider.

| Pros | Cons |

|

|

Weighing these benefits and drawbacks can help you decide whether a finance career suits you.

Finance Licensure and Certifications

Finance certifications and licenses can increase your knowledge and open new job opportunities.

Common certifications include:

- Accredited Estate Planner (AEP): It’s necessary to complete two graduate courses offered by the American College of Financial Services to earn this credential.

- Chartered Financial Analyst (CFA): This certification demonstrates expertise in investment analysis, portfolio management, and wealth planning.

- Chartered Property Casualty Underwriter (CPCU): This certification is designed for people who want to assess and manage risk for insurance companies.

A finance professional certification can help give you a competitive edge when applying for jobs or promotions.

Is Financial Aid Available?

Many finance majors seek scholarships and other types of assistance to reduce the costs of their programs. Some professional organizations offer competitive grants and scholarships for students studying finance. You may be required to write an essay and submit transcripts to apply for this aid.

Editorial Listing ShortCode:

In addition, the federal government provides several kinds of financial aid for qualifying students. You can see if you’re eligible for grants, scholarships, or work-study programs. Also, many students take out federal student loans. You can learn more about these opportunities and determine your eligibility by visiting the Federal Student Aid website.

What Is a Finance Major?

A finance major is designed for students who want to expand their knowledge of business practices, finance theories, and risk management.

You can learn how to manage money and mitigate risk for individuals and organizations. You’ll also study business ethics and financial regulations. In addition, this degree helps students develop many versatile skills. For example, you can learn to analyze financial data and make investment decisions. You can also develop interpersonal skills like communication, critical thinking, and leadership.

Graduates apply their finance knowledge and skills in many industries, such as agriculture, e-commerce, finance, healthcare, and insurance.

Is Finance a Good Career Path?

Yes, finance is a good career path for many professionals. Many jobs in this field can offer above-average salaries and job security. For example, data from the Bureau of Labor Statistics shows that financial managers earn a median wage of $139,790, while financial and investment analysts make a median of $95,080.

In addition, a finance degree enables you to develop a versatile skill set that you can use to pursue many career paths. For instance, many graduates work in the finance industry as accountants, financial analysts, and financial examiners. The government also hires finance majors as auditors and compliance officers.

What Jobs Can You Get with a Finance Degree?

If you’re considering a finance major, you’re likely wondering, “What can I do with a finance degree?” Well, current professionals pursue many jobs with a finance degree.

Many graduates pursue work as financial analysts. Becoming a budget analyst is another popular career path. These professionals help organizations allocate resources and develop budgets. Some graduates work as actuaries. These specialists use financial models and statistics to forecast risk.

It’s also common for finance professionals to work as personal financial advisors. They assist individuals with financial decisions and investment strategies.

How Much Do Finance Majors Make?

The analytical skills and business knowledge you can gain as a finance major may help you qualify for a variety of high-paying careers.

Data from the Bureau of Labor Statistics shows that actuaries earn a median wage of $113,990. Additionally, budget analysts make a median age of $82,260, while the median salary for financial and investment analysts is $95,080. Similarly, $102,120 is the median age for financial risk specialists.

Editorial Listing ShortCode:

Management roles in finance institutions and other corporations may pay higher salaries. For instance, financial managers have a median salary of $139,790. All in all, many factors can influence your career trajectory and salary, such as certifications, education, experience, networking, and skills.

What Skills Do You Learn in Finance?

A finance degree enables students to strengthen many interpersonal and technical abilities, such as:

- Communication. You’ll learn how to deliver presentations and write reports.

- Data analysis. You’ll use digital tools and statistics to harvest and interpret financial data.

- Decision-making. You’ll develop strategies to make ethical, data-driven

- Financial modeling. You’ll use math and software to predict future financial performance and detect potential risks.

- Leadership. You can improve your ability to manage teams and mentor colleagues.

- Problem-solving. You’ll learn how to develop innovative solutions to business challenges.

These skills are in high demand in many industries.

What Entry Level Finance Jobs Can I Get?

People often ask, “What can I do with a degree in finance?” An undergraduate degree in this field can help you qualify for many entry-level positions. These jobs typically require minimal or no work experience in the industry.

Below are a few entry-level finance jobs and their median salaries, based on data from the Bureau of Labor Statistics:

- Financial risk specialists — $102,120

- Personal financial advisors — $95,390

- Financial and investment analysts — $95,080

- Budget analysts — $82,260

- Accountants and auditors — $78,000

- Loan officers — $65,740

You may increase your earning potential by attending a prestigious finance program, earning certifications, and being willing to relocate.

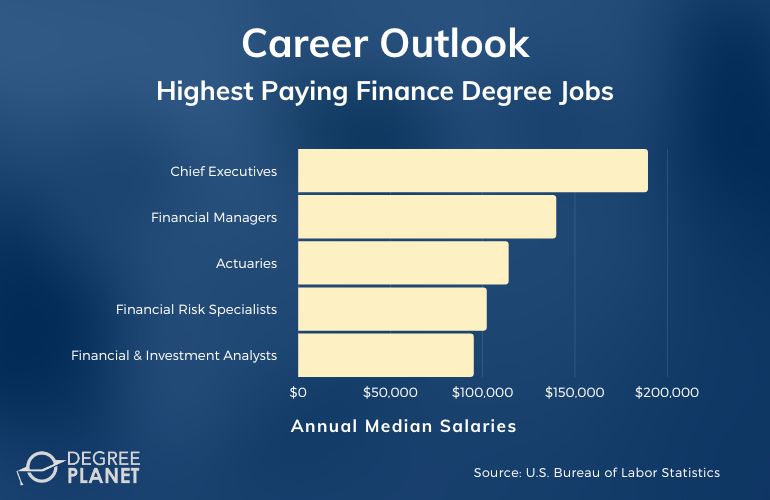

What Highest Paying Finance Degree Jobs Can I Get?

Many finance professionals earn salaries close to or above six figures. According to the Bureau of Labor Statistics, here are some of the highest-paying jobs associated with finance, along with their median salaries:

- Chief executives — $189,520

- Financial managers — $139,790

- Actuaries — $113,990

- Financial risk specialists — $102,120

- Financial and investment analysts — $95,080

More lucrative finance jobs often require several years of experience. Some leadership roles may also acquire additional certifications or education.

What’s the Difference Between Finance vs. Accounting?

Accounting and finance degrees cover some of the same topics and skills, but these majors have several significant differences.

| Accounting | Finance |

|

|

If you want the freedom to explore many career opportunities, a finance degree could be a strategic choice.

Is a Finance Degree Worth It?

Yes, a finance degree is worth it for many students. As a finance major, you can broaden your knowledge of business strategies, investments, and modern financial systems.

A finance degree may be particularly fulfilling if you enjoy math and statistics. You can learn how to analyze data and forecast future financial trends quantitatively. Also, you can develop complex financial models to help organizations understand their current and potential performance.

Editorial Listing ShortCode:

According to the Bureau of Labor Statistics, 7% job growth is projected for business and financial occupations over the next ten years. This growth rate is steady and about as fast as the average for all occupations.

Getting Your Finance Degree Online

If you enjoy doing math and studying financial concepts, you might consider an online finance degree. This major allows you to learn about intricate financial systems and explore techniques to manage and grow assets.

Some programs also let students specialize in areas like corporate finance and financial management. You may qualify for many career paths with a finance degree. Current professionals work for financial institutions, government agencies, sales companies, and other organizations.

If you’re ready to take the next step toward becoming a financial professional, you can start researching online finance degree programs from accredited schools today.