Is accounting a good major? This is a top question that many incoming college students ask. If you like working with numbers or have your sights set on a business career, choosing to major in accounting might be a good path for you.

Accountants and other financial professionals possess skills that are needed in nearly every industry, including government, business, manufacturing, and banking settings.

Editorial Listing ShortCode:

To learn more about a major in accounting, you can take a look at some of the classes you’d take and the job opportunities this degree might provide.

Is Accounting a Good Major?

Yes, accounting is a good major for many undergraduate students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years.

The auditing and accounting professions pay an average annual salary of $73,560 (Bureau of Labor Statistics). This job category includes a variety of work settings, including government departments, corporate businesses, tax agencies, and self-employment.

Potential job titles include management accountant, external auditor, and public accountant. Accounting is versatile.

While it’s common for graduates to become bookkeepers or accountants, you can also consider other career paths, like becoming a cost estimator or a financial analyst. The average annual salary for financial analysts is $83,660.

Editorial Listing ShortCode:

Earning a degree in accounting can help put you on the path toward earning industry certifications in auditing, accounting, financial planning, and other specialties.

Becoming certified can bolster your resume or open new doors. Education and experience requirements vary from one program to the next, but a bachelor’s degree is often the first step.

With an accounting degree and experience, professionals in the field can pursue management positions in finance firms, insurance companies, manufacturing companies, and government agencies. Financial managers often earn between $70,830 and $208,000.

Accounting Major Curriculum

Accounting majors typically earn 120 credit hours while working toward a bachelors degree. The business department usually houses the accounting program, so you can expect to take a mix of general business courses as well as accounting-specific ones. Examples include:

- Cost Accounting

- Financial Markets

- Fundamentals of Auditing Practice

- Information Systems for Accounting Practice

- Introduction to Financial Accounting

- Intermediate Accounting

- Law and Ethics for Business

- Principles of Management and Leadership

- Tax Accounting

- Understanding Risk Management

In addition to classes, some accounting programs include internship opportunities. During an internship, you’d put your classroom lessons into practice while working alongside accounting professionals in a business setting.

Top 5 Things You Can Do with an Accounting Degree

You might picture an accountant sitting at a desk with a pencil behind their ear as they punch numbers into an adding machine, but there’s a lot more to the accounting field than that.

Getting your degree in accounting may lead to many intriguing job opportunities, such as the top suggestions listed below.

1. Management Accountant

A management accountant is employed by an organization to take care of its internal accounting needs. Companies use reports from their management accountants to understand their financial position and guide their business decisions.

Not everyone who works in this field goes by the title of management accountant. If this is the type of job you’re interested in, you can also look for openings for private accountants or cost accountants.

2. Public Accountant

Rather than being employed by one specific company, public accountants do accounting work for multiple clients. Some public accountants are self-employed. Others work for accounting firms that provide services to a variety of individuals or organizations.

Public accountants usually take care of tasks related to government reporting requirements. They can also conduct forensic work to investigate fraud or legal matters.

3. External Auditor

If the idea of investigation is intriguing to you, then you may consider a career as an external auditor. External auditors review other organizations’ financial records, searching for errors or other discrepancies.

Editorial Listing ShortCode:

Some record-keeping problems are unintentional mistakes, but they can also serve as signs of fraudulent activity. As with public accountants, external auditors can be self-employed or work for firms that conduct audits of multiple organizations.

4. Financial Examiner

Being a financial examiner is another job that involves poring over records. Financial examiners can investigate compliance with local and federal financial regulations.

They can also make sure that financial institutions use fair consumer practices. One reason this is a top job choice for accounting majors is that financial examiners are in demand. The Bureau of Labor Statistics is predicting 7% job growth over the next decade.

5. Controller

If one of your goals is to become a leader in your organization, you may want to work towards the role of controller. In many settings, the controller is in charge of the accounting and auditing teams. The controller may also oversee budgetary activity.

For success as a controller, it’s helpful to be good at preparing a variety of financial reports. It’s also necessary to become familiar with government regulations and requirements.

Accounting Careers

Accounting majors can consider a variety of career paths related to money and other business matters. According to the Bureau of Labor Statistics, jobs in business and finance pay an average annual salary of $72,250.

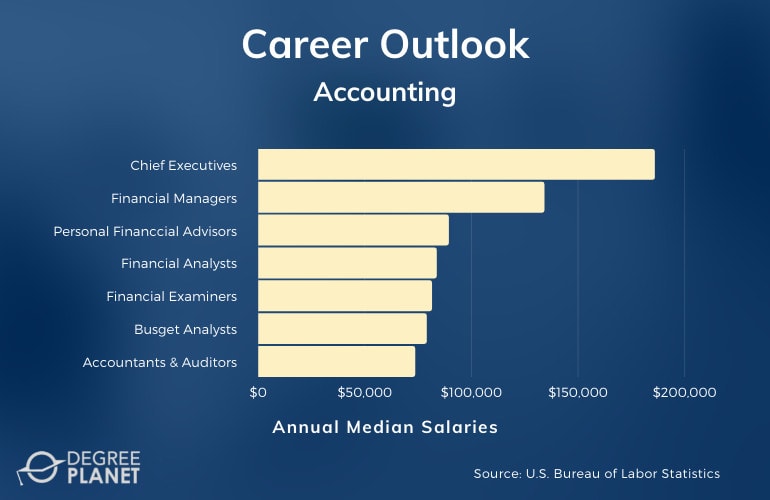

| Careers | Annual Median Salaries |

| Chief Executives | $185,950 |

| Financial Managers | $134,180 |

| Personal Financial Advisors | $89,330 |

| Financial Analysts | $83,660 |

| Financial Examiners | $81,430 |

| Budget Analysts | $78,970 |

| Accountants and Auditors | $73,560 |

| Cost Estimators | $66,610 |

| Tax Examiners and Collectors and Revenue Agents | $55,640 |

| Bookkeeping, Accounting, and Auditing Clerks | $42,410 |

While many entry-level accounting jobs require only a bachelors degree, graduate studies could lead to industry certifications or job promotions.

How to Know If a Degree in Accounting Is Right for You

Individuals and businesses are always going to rely on professionals with accounting expertise, so an accounting degree might lead to various job opportunities. Gaining in-demand skills isn’t the only reason to choose a particular degree, though. It’s also wise to pursue a path that complements your skills and temperament.

You might be a good fit for accounting if your strengths include:

- Analytical thinking

- Attention to detail

- Clear communication

- Multitasking

- Number sense

- Organization

In accounting, being careful with the little things—such as the accuracy of digits or the way you present information—can make all the difference in your success.

Is Accounting Hard?

Accountants spend a lot of time working with numbers and studying financial data. During your program, you’ll likely take course topics like intermediate accounting and advanced accounting to learn how to read financial statements. Your studies should also train you to write financial reports.

Math courses can be a critical part of your curriculum. Depending on your program, you might take algebra, statistics, or calculus.

Editorial Listing ShortCode:

Proficiency with software can help you succeed in this field. In a class that covers accounting business applications, you’ll practice using spreadsheets and other computer programs that are helpful in day-to-day accounting practice.

Do You Need to Be Good at Math to Be an Accountant?

Being comfortable with numbers is a key characteristic for most successful accounting majors. You can expect to spend a lot of time inputting numbers and doing calculations. Even still, there’s a limit to how much math is required for a job in accounting. Many professionals in this field don’t use higher-level math, like calculus, on a regular basis.

How many math classes are required for an accounting degree varies from school to school. Depending on the curriculum, you may take college algebra, college precalculus, business calculus, or statistics.

How Much Do Accountants Make?

Figures from the Bureau of Labor Statistics show that the median annual salary for jobs in business and finance is $72,250 per year. For accountants and auditors, the average salary is $73,560. Most earn between $45,220 and $128,680. Some of the highest accounting wages are with federal government agencies.

Personal financial advisors often make between $44,100 and $208,000 each year. Becoming certified in this industry can often lead to more clients and higher earnings.

Moving into management roles might bring salary increases as well. Financial managers average $134,180 in earnings annually. Chief executives, such as chief financial officers, average $185,950.

What Can You Do with an Accounting Degree?

Accounting degrees can help prepare you for all sorts of jobs related to money and numbers. You can look into working for a private company as a cost accountant or think about preparing tax returns for individuals as a certified public accountant.

Others might be interested in your guidance on money matters. Personal financial advisors can manage clients’ investments and help them plan for the future.

According to the Bureau of Labor Statistics, an accounting bachelor’s degree may also qualify you for various management jobs. Examples include treasurer, insurance manager, or cash manager.

How Long Does It Take to Get an Accounting Degree?

Earning a bachelors degree, whether in accounting or another field, generally takes about 4 years. During that time, you’ll take an assortment of classes—both courses from the accounting department and general education courses.

Although going to college for 4 years is standard, there are ways to speed up the process of earning your degree. Online college programs sometimes have short-term courses that you can complete in less time than traditional courses. You might also be able to shorten your studies by transferring in classes or receiving credit for your prior knowledge.

What Jobs Can You Get with an Accounting Degree?

Accounting majors tend to work as accountants. According to the Bureau of Labor Statistics, there are both public accountants, who work for a variety of clients, and management accountants, who perform internal work for one specific employer. In addition, some accountants work for the government.

Studying accounting can sometimes lead to auditing jobs. If you’re interested in technology, you might consider becoming an IT auditor. This role evaluates the reliability and integrity of the technology used for financial transactions and record-keeping.

Editorial Listing ShortCode:

Accounting degrees are also useful for jobs in budget analysis. A budget analyst helps organizations make plans for how to allocate their financial resources.

What Can I Do with an Accounting Degree Besides Accounting?

With an accounting degree, you can consider going into the construction industry. Building projects need cost estimators who can provide reliable information about the time and funds that the company will have to invest.

Also, accountants have skills that are useful in revenue agencies. When working for a government tax department, you might collect payments or analyze tax returns. Accounting and finance are closely related. You might qualify for finance-related jobs, such as financial examiner, risk manager, or budget analyst.

Are Accountants in Demand?

According to the Bureau of Labor Statistics, the business and financial occupations sector is expected to grow 5% through the next decade. That’s faster than the average growth rate for all occupations.

For accounting and auditing jobs in particular, the growth rate is expected to be 4%. Companies and individuals always need accounting. As long as there are transactions to record, taxes to file, and budgetary decisions to make, people will be relying on the expertise of accountants.

What’s the Difference Between Finance vs. Accounting?

In general, the field of finance has to do with making monetary plans and investments. Accounting deals with keeping track of transactions and taxes.

Topics in finance studies include:

- Financial institutions

- Global markets

- Investment portfolios

- Risk management

Topics in accounting programs include:

- Auditing

- Cost accounting

- Fraud investigation

- Tax accounting

Despite these differences, there can be some overlap in finance and accounting jobs. Some students even pursue a combined degree in which they study both disciplines.

What’s the Difference Between Computer Science vs. Accounting?

Both computer science and accounting programs rely on math skills, but these two degrees can take you in very different directions.

Computer science addresses:

- Hardware and software

- Online security

- Networks

- Programming languages

Accounting focuses on:

- Budgets

- Business practices

- Financial records

- Taxation

If you’re interested in both disciplines, you may consider a career in IT auditing. This type of career requires knowledge about both financial reporting and technology systems. Taking courses from the school’s computer and business departments can help equip you.

Is Accounting Worth It?

Yes, an accounting degree is worth it for many professionals. This in-demand line of work is always needed for the management of companies and people’s personal finances.

The Bureau of Labor Statistics projects that jobs for accountants and auditors will grow 4% over the next ten years. Plus, studying accounting can give you a good foundation for other aspects of business as well. That versatility may help you move into a finance role or pursue a management position.

For many students wondering whether accounting is the right path, earning an accounting certificate is worth it in helping them decide whether to continue on in a bachelor’s program.

Getting Your Degree in Accounting Online

If you like working with numbers, you may consider an accounting major. This degree program teaches you how to read financial statements, analyze them, and prepare them yourself. The skills you learn may lead to a career in government, business, or self-employment.

In addition to accounting, career possibilities in this field include auditing, cost estimating, and financial advising. There are a variety of management roles in this field, so you may have opportunities for career growth and advancement as well.

If accounting is right for you, you may want to take a look at the possibility of earning an accredited accounting degree online!