Is an accounting degree worth it? With high earning potential and a wide variety of career options, there are many great potential benefits to an accounting degree.

Editorial Listing ShortCode:

As you consider whether an accounting degree is right for you, it’s helpful to look at the potential jobs, salaries, and academic requirements associated with the degree.

Is an Accounting Degree Worth It?

Yes, an accounting degree is worth it for many students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years.

Common accounting careers in this field include:

- Accountant

- Bookkeeper

- Budget analyst

- Financial manager

- Loan officer

- Claims adjuster

Another benefit of an accounting degree is the way that you can customize it.

Editorial Listing ShortCode:

Depending on your interests, you may specialize in any number of concentrations, including:

- Tax auditing

- Payroll processing

- Forensic accounting

- Cost accounting

- Government accounting

- Accounting information systems

Accounting degrees are available at every level of education. You may start with an associate degree and work your way up to a bachelor’s, master’s or doctorate. In many cases, your credits will transfer with you.

In the accounting industry, different careers often require different levels of education. For example, a two year degree might qualify you for entry-level bookkeeping jobs, but to become a senior controller or appraiser, you’ll probably need a four year degree or more.

How to Decide Whether an Accounting Degree is Right for You

Trying to decide if a traditional or online degree in accounting is right for you? Here are some of the qualities that can help you succeed in an accounting degree program.

1. You’re good with numbers.

Mathematics is the foundation of accounting, however, it is one of the fundamentals that makes accounting a hard major. So, if math is your strong suit, it may make an accounting program much easier for you. Your curriculum will probably have required classes like algebra, calculus, statistics, derivatives, and economics.

You might also be encouraged or required to complete practicums or internships where you work directly with numbers in a supervised setting. And if you pursue an accounting career, you’ll likely have to deal with statistics and figures on an everyday basis.

In other words, an accounting degree is often a good match for students who work well with numbers. You should be familiar with the basic skills and concepts of the field, and you should be comfortable learning new ones as they appear.

2. You’re okay with continuing your education throughout your life.

As an accountant, your education likely won’t stop when you graduate from your degree program. Many careers ask for additional licenses or certifications like a Certified Public Accountant (CPA) licensure. These certifications may require special learning programs or exams.

Some programs may also ask you to renew your license every few years. Depending on the specifics, this might require re-testing to ensure that you’re up to date with contemporary standards and practices.

3. You want to work in a finance related field.

Accounting degrees don’t entirely limit you to the world of finance. For example, you might be able to earn an accounting degree and apply it to a business job, or use it as a springboard for further education in data or technology.

However, most accounting degrees lead to accounting careers. These may include finance, economics, human resources, and business intelligence.

Accounting is considered a “specialist” degree. This means that it can help prepare you for a specific type of work. It’s different from a “generalist” degree that can be applied to a broad range of jobs and industries.

5 Things You Can Do with an Accounting Degree

Accounting is a good major for many students and there are numerous opportunities for accounting graduates. It’s just a matter of figuring out where your interests lie and how you can apply your skills and specializations to a relevant career.

Here are just a few of the many careers that may result from an accounting degree:

1. Accountant

Accountants deal with finances. Whether it’s crunching numbers, creating spreadsheets, tracking statistics, calculating risks, or auditing financial records, their primary responsibilities revolve around the upkeep of financial data for a specific purpose or organization.

Editorial Listing ShortCode:

They need a good sense for numbers and a strong attention to detail. They can have different specialties and sub-specialties like cost accounting, forensic accounting, and tax accounting.

2. Financial Analyst

Financial analysts work with investments. They may advise individuals and businesses who want to invest, or assume management positions overseeing a company’s ongoing investments.

They are expected to know their way around things like stocks and bonds.

3. Bookkeeper

Bookkeepers are responsible for the “books” or “ledgers” of a company. This may include everyday expenses as well as overarching credits, debits, profits, margins and more. Depending on their level of education, bookkeepers can play a variety of roles within an organization.

A senior-level bookkeeper might be a highly-qualified finance professional with a master’s degree, while an entry-level bookkeeper might be a college intern working towards an associate degree.

4. Human Resources Specialist

The human resources (HR) department deals with the management of a company’s employees.

For accountants, this usually involves payroll, benefits, insurance, and other forms of compensation. However, it may also cross over into recruitment or labor relations when contracts or salaries are involved.

5. Payroll Clerk

Payroll clerking is an entry-level position for accounting students. It can usually be obtained with an associate degree or less.

Comem duties include tracking paychecks, organizing time sheets, performing basic data entry, and managing account information for employees.

Accounting Degree Alternatives

Accounting isn’t the only major that can help prepare you for jobs in the financial sector. There are several alternatives, including:

- Bachelor’s in Finance. This is a broad, wide-ranging field that may launch many different careers such as analyst, actuary, investor, trader, or portfolio manager. This degree is much more “generalist” than an accounting degree.

- Bachelor’s in Data analytics. A degree in data analytics help you learn how to glean useful information by inspecting and modeling data. Graduates in data analytics also often go on to become financial analysts.

- Bachelor’s in Economics. Accounting topics often overlap with economic ones. If you’re already taking college classes, your core subjects might fulfill a lot of the same prerequisites, whether you decide to go with accounting or economics.

If you don’t want to leave your accounting program, you can also consider switching specializations. You might be able to narrow in on your area of interest by shifting your concentration.

Accounting Careers & Salaries

According to the Bureau of Labor Statistics, accountants and auditors make a median salary of $73,560 per year. The highest-paid accountants are often in the finance and insurance industries. Other industries include business, management, government, tax preparation, and payroll services.

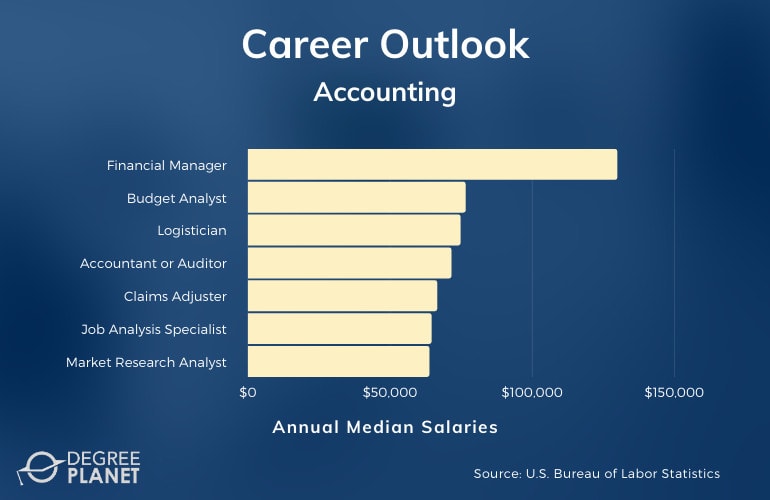

Here are a few common career paths for accounting students, with their median annual salaries:

| Careers | Annual Median Salaries |

| Financial Manager | $134,180 |

| Budget Analyst | $78,970 |

| Logistician | $76,270 |

| Accountant or Auditor | $73,560 |

| Claims Adjuster, Appraiser, Examiner, or Investigator | $68,130 |

| Compensation, Benefits or Job Analysis Specialist | $67,190 |

| Market Research Analyst | $65,810 |

| Loan Officer | $63,960 |

| Fundraiser | $59,610 |

| Tax Examiner or Collector | $55,640 |

Keep in mind that all of these figures are median rates. Your exact salary can depend on things like age, experience, industry, seniority, educational level, job title, job demand, and more. Even your geographic location may have an impact on your wages.

How Much Does an Accounting Major Make Out of College?

Accountants may make a salary of anywhere from $45,220 to $128,680 per year, according to the Bureau of Labor Statistics. The lower end of that range usually belongs to entry-level jobs, but earning potentials vary by industry, educational level, and more.

Editorial Listing ShortCode:

For example, rare and in-demand specializations might have higher salaries than commonplace ones. Master’s degree holders might make more than bachelor’s degree holders.

Is It Hard to Get a Job With an Accounting Degree?

The difficulty of getting an accounting job can depend on many different factors, including your location, certification, degree level, and previous experience within the field.

There can also be fluctuating demand for accounting professionals in different places or within different fields. Speaking very generally, however, the outlook is positive for accounting students entering this growing field.

The Bureau of Labor Statistics estimates that the occupational growth rate for accountants and auditors is 4%. The estimated growth rate for financial jobs in general is 5%. This translates to over 476,000 new jobs within the next decade.

Getting Your Accounting Degree Online

An accounting degree may be the first step to a successful career in finance. Whether you’re interested in accounting, appraising, bookkeeping, fundraising, or payroll clerking, the skills that you can learn in an accounting program can help qualify you for these and other jobs in finance.

An accounting degree may also open the door to high salaries and in-demand specializations with lots of opportunities for growth. The first step, however, is to find and enroll in a degree program that is right for you. With countless online accounting programs available, a degree in accounting may be within reach.